Console War Ends?

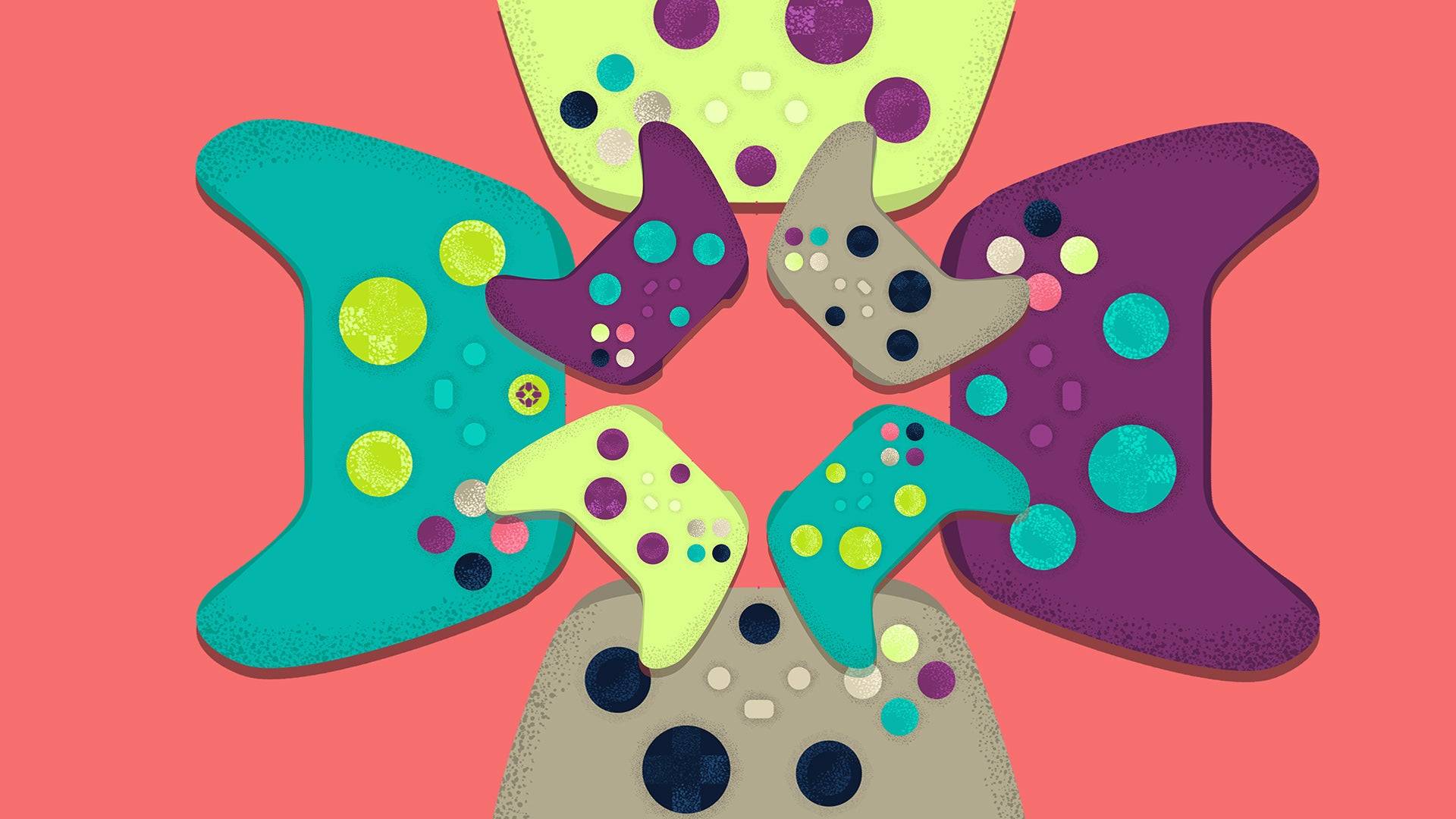

The age-old question: PlayStation or Xbox? This debate has raged for years, sparking countless online discussions and heated arguments among friends. While PC and Nintendo enthusiasts exist, the rivalry between Sony and Microsoft has largely defined the gaming landscape for two decades. But has this "console war" truly concluded? The industry has undergone a seismic shift, fueled by the rise of mobile gaming and a younger generation adept at building their own PCs. The battlefield is unrecognizable, and a victor may have emerged—though the answer might surprise you.

The video game industry has exploded into a financial powerhouse. Generating $285 billion in 2019, it soared to $475 billion in 2023, surpassing the combined revenue of the global movie and music industries. This growth shows no signs of slowing, with projections nearing $700 billion by 2029. This meteoric rise has attracted Hollywood A-listers like Mads Mikkelsen, Keanu Reeves, and Willem Dafoe, reflecting the industry's elevated status. Even Disney, with its $1.5 billion investment in Epic Games, is vying for a larger piece of the pie. Yet, amidst this boom, one giant seems to be struggling: Microsoft.

The Xbox Series X and S, intended as significant upgrades, haven't quite captivated the market. The Xbox One still outsells them nearly two-to-one, and industry expert Mat Piscatella suggests this console generation has peaked. This, coupled with Xbox Series X/S sales of under 2.5 million units in 2024 (compared to the PlayStation 5's 2.5 million in *just the first quarter*), paints a bleak picture. Rumors of Xbox closing its physical game distribution department and potentially withdrawing from the EMEA console market further fuel these concerns. If this was a war, Xbox appears to be signaling a retreat.

But the retreat is already complete. Internal Microsoft documents revealed during the Activision-Blizzard acquisition proceedings show the company doesn't believe it *lost* the console war—it believes it never had a chance. So, what's a console-centric company to do when its latest model underperforms and its parent company acknowledges its failure? It pivots.

Xbox isn't retreating—it has already surrendered. Xbox Game Pass has become a central focus. Leaked documents reveal the substantial costs associated with adding AAA titles like *Grand Theft Auto V* ($12-15 million/month) and *Star Wars Jedi: Survivor* ($300 million) to the subscription service. This highlights Microsoft's commitment to cloud gaming. Their recent "This Is An Xbox" campaign reinforces this shift, rebranding Xbox not as a console, but as an always-accessible service with complementary hardware.

This reimagining extends beyond the traditional console. Rumors of an Xbox handheld, supported by leaked documents hinting at a next-gen hybrid cloud gaming platform, are circulating. Microsoft's strategy is clear: mobile gaming dominance is shaping their future. From plans for a mobile game store to compete with Apple and Google to Phil Spencer's acknowledgement of mobile gaming's influence, the message is simple: Xbox is wherever and whenever you want to play.

Why this pivot? While Xbox has struggled, the console market isn't the undisputed king. In 2024, of 3.3 billion estimated gamers, over 1.93 billion played on mobile devices. This includes casual players and those who wouldn't consider themselves "gamers." Mobile gaming is now a dominant force, particularly among Gen Z and Gen Alpha. In 2024, the mobile gaming market represented exactly half of the $184.3 billion video game market—$92.5 billion, a 2.8% increase from the previous year. Consoles? Just $50.3 billion (27%), down 4% from 2023.

This isn't a recent development. By 2013, the Asian mobile gaming market significantly outpaced the West. *Puzzle & Dragons* and *Candy Crush Saga* out-earned *Grand Theft Auto V* that year. Five of the highest-grossing games of the 2010s were mobile titles. Mobile gaming's impact is undeniable, even if some of those titles aren't instantly recognizable.

Mobile gaming has quickly become the dominant pillar among every generation, but especially Gen Z and Gen Alpha.

Beyond mobile, PC gaming's growth is also noteworthy. Since 2014, 59 million new PC players have joined the market, reaching 1.86 billion in 2024 (with a significant surge in 2020 due to the pandemic). Increased technological literacy, fueled by online communities, has empowered players to build high-performance PCs. However, despite this growth, the PC market's share in 2024 ($41.5 billion) still lags behind consoles, with a widening gap of $9 billion compared to 2016.

But the mobile and PC markets aren't Xbox's only challenges. Let's examine PlayStation's performance. Sony's latest earnings report boasts 65 million PS5 sales—a substantial lead over the Xbox Series X/S's combined 29.7 million. For every Xbox sold, five PS5s are purchased. Sony's Game and Network Services also saw a significant profit increase, driven by strong first-party sales. Ampere Analysis predicts Sony will sell 106.9 million PS5 consoles by 2029, while leaked Microsoft documents estimate 56-59 million Xbox Series X/S sales by 2027. To regain competitiveness, Microsoft needs to drastically improve sales and profitability of its exclusives, a challenge given Phil Spencer's openness to releasing Xbox titles on PlayStation and Switch.

However, the PS5 isn't without its weaknesses. Around 50% of PlayStation users still play on PS4s. Of the top 20 best-selling games in the U.S. in 2024, only one is truly PS5-exclusive. The limited number of exclusive PS5 titles (around 15, excluding remasters) may not justify the console's price for many consumers. The PS5 Pro's launch also received a mixed reception, with many feeling it arrived too early and offered insufficient upgrades. The PS5, while successful, isn't a must-have yet, though *Grand Theft Auto VI*'s release may change this.

AnswerSee ResultsSo, is the console war over? For Microsoft, it seems there was never a real chance to challenge Sony. For Sony, the PS5 is a success but not a revolutionary leap. The true winner? Those who avoided the conflict altogether. The rise of mobile gaming, with companies like Tencent making significant acquisitions, will continue to reshape the industry. Mobile gaming's importance to profitability is undeniable; Take-Two Interactive notes that 10% of the world's population plays its Zynga games monthly. The future of gaming will be less about hardware and more about cloud infrastructure. The console war is over, but the mobile gaming war—and its associated conflicts—has just begun.

Latest Articles

![Taffy Tales [v1.07.3a]](https://imgs.anofc.com/uploads/32/1719554710667e529623764.jpg)